Soon after the mysterious Satoshi Nakamoto created Bitcoin, several other cryptocurrencies emerged, taking the world by storm. Today we have the likes of Cardano, Ethereum, Litecoin, and Tether, which have people frantically investing in them. According to some economic analysts, cryptocurrency is expected to go through a big change with institutional money entering the market. Others think that cryptocurrencies need a verified ETF (exchange-traded fund) that will make it easier for new candidates to invest in Bitcoin. So far, cryptocurrencies are undeniably all the rage these days.

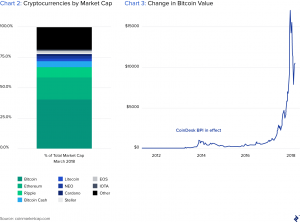

According to a recent study by Tech Jury, Bitcoin was reported to have a market capitalization of $1.072 trillion as of February 2021. The global blockchain market is projected to reach $23.3 billion by 2023. Furthermore, the market size for cryptocurrency is expected to reach $1.087 billion by 2026, with a user index of 97% confidence in cryptocurrencies for 2021. It is important to note here that while Bitcoin was worth only $10,000 a year ago, it reached a price of $30,000 in January 2021.

Your Castle Filled With Gold Awaits

There is no question that Millennials are quickly emerging as the holder of cryptocurrencies more than any other generation. However, investing in a digital asset requires considerable judgment and precautionary measures. The following are good examples through which the young and the earnest can invest in cryptocurrency without crossing a stringent line of Invest In Bitcoin that results in failure or depletion of ROI (return on investment).

· Automated Bots

Simply put, crypto trading bots are automated software that can help you buy and sell cryptocurrencies at the right time. While crypto trading bots do offer you some slack, it is important to note here that not all bots are profitable; hence relying on them completely would be a mistake. Bots that make expedient decisions are rare; therefore, you still need to stay vigilant.

However, having said that, you can still train bots to carry out important decisions for you, such as signal you when it’s the right time to take a decision, or calculate the risk involved so that you can make better and more informed decisions. Here are some examples of good crypto trading bots:

- Bitsgap

- Cryptohopper

- Mudrex

- Pionex

- Quadency

· Best Crypto Wallets

Cryptocurrency wallets are applications that allow you to store and retrieve your digital assets. This is because, unlike fiat or conventional currency, cryptocurrency is in the form of a digitally encrypted file. There are several benefits of using cryptocurrency wallets: keep yourself in check, stay safe from fraud, save your time, and make transactions much easier to Invest In Bitcoin. Some of the best cryptocurrency wallets for 2021 include:

- BitGo Cryptocurrency Wallet – market leader in institutional asset financial services

- Coinbase Wallet – the world’s most popular way to buy and sell leading cryptocurrencies

- Electrum Wallet – developed by Thomas Voegtlin and continues to evolve to this day

- Exodus – one of the best crypto wallets for desktop and mobile devices

- Jaxx – can serve as a wallet for a wide variety of cryptocurrencies out there

· Choose the Best Platforms for Trading

The platforms you choose for trading cryptocurrency also matter a lot as you want to deal with credible authorities with a considerable reputation in the crypto market. This ensures that you are dealing with renowned professionals and that they carry substantial worth. Here are some of the best platforms that you can use to trade cryptocurrency:

- Binance – best for Altcoins and offers 100 different trading pairs

- Bisq – best for decentralized cryptocurrency exchange

- Cash App – best for beginners interested in peer-to-peer transfer

- Coinbase – best overall with user-friendly interface

- Coinbase Pro – different but cheaper fee structure

· DeFi Yield Farming

Yield farming is basically a way to make more cryptocurrency with the cryptocurrency you already own. This involves the lending of your assimilated funds to others through smart contracts. DeFi itself stands for Decentralized Finance, where investors (farmers) compete against each other to get a chance to farm (yield) the best crops (cryptocurrency). Here are some of the best DeFi Yield platforms that can help you along the way, such as:

- Autofarm – over 30 liquidity pools with substantial APYS(APYSwap)

- Bearn – provides an extensive yield farming ecosystem with bVault’s outrageous awards

- Pancake Bunny – a DeFi yield farm and aggregator that compounds your Pancakeswap yields

- PancakeSwap – the leading automated market maker and the first billion-dollar project on Binance

- Venus – an algorithmic money market for decentralized lending and borrowing

· Faucets

Crypto faucets is another way to earn cryptocurrencies and increase your holding. Many crypto faucets offer a reward system that offers Satoshis that can be earned by Invest In Bitcoin various tasks. A Satoshi is basically one-millionth of Bitcoin, and this is indeed a practical approach because just 0.10 BTC can be worth thousands of dollars. Some of the best crypto faucets out there include:

- Bitcoin Aliens

- BonusBitcoin

- Coinbase

- CoinPayu

- Cointiply

How to Suffer No Damages

If you have experience dealing with rare commodities and valuable items before, you know that the market doesn’t always standstill, and there are always fluctuations. Here is a quick rundown of assessing risks and utilizing adequate solutions to prevent losses in your cryptocurrency holdings.

· Risk Assessment

The main risk involved in trading in cryptocurrencies is its volatility. With unexpected changes in the market sentiments, cryptocurrencies can be influenced to Invest In Bitcoin sharp and sudden movements. While the value of cryptocurrencies can drop by hundreds quickly, those who have dealt with volatile markets know not to panic.

· Viable Solutions

One way to prevent your losses in cryptocurrency is to deploy a stop-loss order. This order works automatically and it closes the crypto position after the price reaches a specific lelvel. Stop-losses can be essential for risk management as with them, traders can calculate what position size to take and how much money should they be willing to risk/invest into a single trade. At Assignment Assistance, young ones are always reminded to trade responsibly.

Best Time to Invest

In an ideal world situation, the best strategy would be to buy low and sell high; however, that is easier said than done. Many experts nowadays use the DCA (dollar-cost averaging) strategy to reduce the impact of market volatility where even Bitcoin suffers from price changes on an hourly as well as a daily basis. For those who are optimistic that their investments will appreciate in the long run, DCA seems to be the right choice.

Conclusion: Invest In Bitcoin

The institutional adoption of the crypto ecosystem is near, and there is no wonder that establishments like MassMutual are willing to Invest In Bitcoin nearly $100 million of their funds into BTC. I hope that this post was able to offer you some meaningful insights as to how you can go about investing in bitcoin and the best time for your investments this year.

If you have any further queries regarding the topic, please feel free to share your ideas by leaving a mention comment section below. That’s it for now. Cheers, and all the best for your future endeavors!

Author Bio

Amanda Jerelyn currently works as a Blogger at Crowd Writer. This is where higher education students can request maestros to do my coursework for me in order to receive specialized assistance for their subjects. During her free time, she likes to surf the internet for the latest developments in the world of tech.